Storytelling — Case Study Baby & Child Retail Growth

Hi,

First of all, this is not going to be a story about my baby or any kind of recommendation to stop the sleepless nights.

I do am in a happy relationship, but we are still not prepared for that kind of an adventure. 👶 🤰

My name is Miguel Macedo (nice to meet you too ✌️), and I work in Ulabox.

We are the #Antisúper that has successfully disrupt the Online Retail in Spain.

Of course, we didn’t do it alone… but as the 1st completely digital supermarket in Spain we are very proud to have been accelerating the process. 🚚 🍉🍫 🍻 🥦 🍼

So, you guess it right… I will tell you a little bit about my adventure here in Ulabox.

I started in Business Intelligence where I was able to learn a lot about the data analysis field and the importance of managing your data in order to best decide where to invest your time and resources. 👩🏻 💻 🕵 🛒💰

“Management is nothing without managing data!”

I did all kinds of dashboards and analysis with different proposes and perspectives, to name a few: 📝📊 📈 📉

External Metrics -> Market Share and Growth Evolution trends.

Internal Sales KPIs -> evolution of different categories and performance of their metrics likes: Penetration, AOV (average-order-value), OOS (out-of-stocks), Margins, Sales, Customers Growth, Long-Tail, etc.

Traffic Analysis -> performance based on different sources and user experience through the Web likes: Conversion Rate, Sessions, Bounce Rate, Campaigns Performance, etc.

Quality Assessment Reports -> control of data quality in BO likes: Content of Products, Availability of Products, Promotion Performance, Estimation of Life Expectancy, etc.

Customers Clustering -> the performance of different clusters of customers and theirs frequency, spent and conversation rate.

Subscription Performance -> we were the first ones in Europe to implement a subscription plan like Club Gillette, and we also offer a subscription plan like Ulabox Plus.

Forecasting Models -> estimated growth on Sales, New Customers, Returning Customers and Orders Delivered.

Pricing -> match and detect price variations over 15.000 products against selected players from the market.

And many times reports based on a single independent action or new proposal theory.

It was a lot of numbers and I loved to see decisions based on my insights being made as a more resulted oriented mindset.

Nowadays I incorporated the Commercial Department, but I’m still responsible for many of the reports above and I never really lost the data analysis profile. 🤓 😋

Here I ended up going through all the categories except Fresh & Dairies.

🍓 🥕🥑🥩🧀 🐟

I started with Long-tail categories like: Ecological and Organic, Gourmet, Gluten Free, etc. Then moved to more mainstream categories like Food & Beverage.

🍫 🍻🍭🍷 🍞 🍪

And now Non-Food categories like: Household, Toiletries and Beauty, Baby, Pet and Drugstore.

🚿 🚽 💇 👼 🐶 👖

I was really lucky because that way I was able to meet and negotiate Joint Business Plans with over more than 150 suppliers, and introduce new partners to our business model. And actually any kind of budget level partners, from the new local organic product brands to the mainstream market already consolidated brands.

And yeah… every supermarket category is a different world with different product characteristics and very distinct consumers habits and expectations.

-> From all the supermarket categories, maybe the most challenging one was Baby. Because of his performance growth trend and consumer profile. <-

BABY

The scenario wasn’t easy with goals not being reached and coming from a place in the beginning of Ulabox, where Baby was the main focus of the company and consequently overestimated.

Baby E-commerce was one of the pioneers in the online world and mainly because it made much more sense.

For a family of four with parents working around the clock, it’s much easier to convince them to purchase their groceries online and expect them to be delivered to your home.

Things turned around… and nowadays the key player is by far Fresh & Dairies. It’s where you are able to create higher frequency, spending, fidelity and in the end higher profit retention with a bigger LTV (life-time-value) customer.

It’s harder to convince someone to purchase fresh product through the internet, but once they do and try our Porta Novau’s Hummus from Mercado del Ninot, they are much more inclined to order it again. 😱 😋

!!!!And voilà you have a sustainable business¡¡¡¡¡

But this was about Babies and not about fruits and vegetables!! 😝🍓 🥦

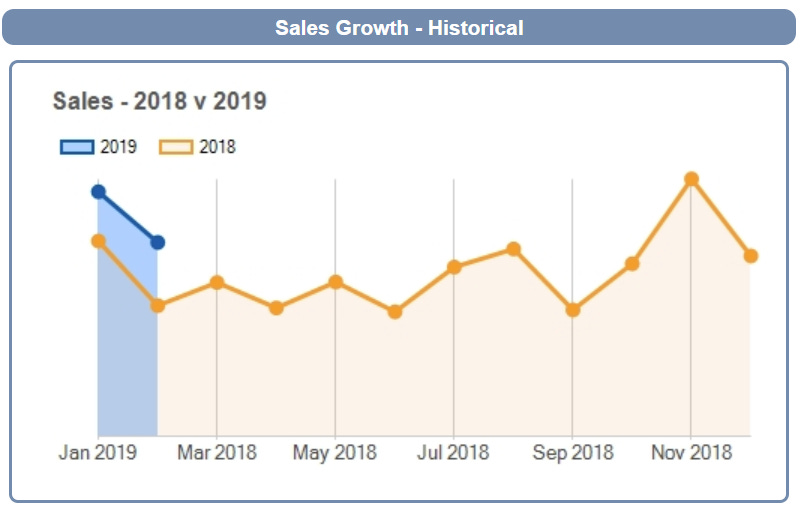

To have some idea of the potential of the category… in UK sales in the Baby & Child eCommerce market increased by an average of 48.49% in February 2019 compared to February 2018. With an Average Order Value of 245€.

Baby’s moms were the first ones to lose the fear to introduce their credit cards in online pages.

So they are much more as experience as a user. And since the category is one of the most promotion dependent they also know much better how to find the best deals and where to find them.

Complicated cross-categories actions have success with baby shoppers because they understand them easily.

So… we were coming from a place where the category had an overestimated penetration comparing to other supermarkets, and customers were much more susceptible to try different competitors. 🙄 🤔

Today, I can proudly say that we have turned things around to accomplish sustainable growth. Many managed actions have been implemented in a transparent and data driven mindset within collaboration with our partners. 👏 👏 👶🏻 👶🏻

How did we do it?

Start with the core structure… naming and product content doesn’t sound as important as pricing, but I can assure you that they are very important to customers to find you. SEO is responsible for a big portion of our traffic and even in SEM and Google Shopping campaigns this type of information can be the difference from a first place position in the web, where everyone click, to the second page position, where no one will ever notice you.

And if you argue that people already wright your name in the search bar, I can promise that will be much easier for them to convert in your shop if they see a coherent naming construction with all the important product details and curiosities that they may be looking for.

An easy and organic user experience is the key to convince customers to purchase.

Btw, another curious impact was that many products only had the Brand Name of the product, but not the type of the product it actually was. So, if you were searching for the type of the product in our internal search tool, it would be very difficult to find the top sellers that you would most probably be looking for… Most of Brands feel like they own the market, but you always should look out for your customers. If they type “diaper” it makes sense that “diaper” is in the naming of the product.

Next… product’s rationalisation, a good experience can be accomplished by cutting products with zero or low rotation volume, making it clear and easy for the top sellers to be reaching out.

And you will have a more cost efficient inventory turnover.

Stocks… It’s a must to have a constant control of your top sellers and their OOS (out-of-stocks).

In this kind of categories you have to be extra careful because your sales are very promotion dependent and running out-of-stock can have a double negative effect. It is not just the customer that doesn’t find the product they need and go elsewhere unhappy with you to look for it. Also, it can negatively impact the supply demand curves, making it a very cost inefficient category.

For the sake of the argument:

Just imagine… that you are running out-of-stocks because you are having a very good promotion campaign with very high conversation rate. You ask for more stock availability to your suppliers and they send it to you. But when the stock arrives to your warehouse and is uploaded into the system, not just the customer is already gone to other competitor of yours as the campaign is already finished.

So, you end up with overstock and without the campaign to liquidate it.

And the worst of all, your name is black bold in the Financial & Logistics Departments’s List of Inventory Turnover. 😬☠️

Pricing… It’s not rocket science to understand that clients always want to pay less. So, if they find the same product in other competitor with a lower price, 9/10 you can consider lost customers. 💸 💰

Not the all 10 because sometimes someone really loves your services and product.

If for any reason you can’t meet the market standard price focus on extra services values for your clients.

Interaction and collaboration with other teams / departments in my opinion, this is a must in any kind of project and Baby wasn’t an exception.

It’s crucial to be able to maintain a constant flow of information between everyone that may be involved with the Category.

The automatisation of dashboards or updates regarding the main KPIs evolutions and the sharing of valuable information concerning multiple types of actions it’s a good way to make everyone feel acknowledge as a member of the project and motivated to surpass any challenge that may occur in the future.

It’s important to avoid mistakes because someone wasn’t notified in time. This goes for every department because many issues are transversal to every sector the company may operate in.

You may think that some peculiar campaign, it’s responsibility of the Marketing team and doesn’t have anything to do with Logistics… until stock limits are reached.

Or you may think that changing a product format only concerns Logistics, until someone in Marketing is still pushing notifications on this old format reference.

This is also valid to third party partners that you may depend on.

It’s easier to thrive when you have the support of all the players in the chain ecosystem.

Here in Ulabox we have a saying:

“Bugs in the system are not the CIO’ responsibility; problems with sales are not the CMO’ responsibility; errors in UX are not the Product Manager’ responsibility… everyone is involved and is responsible!”

Be creative! Most likely you already know the different dimensions/stages of a Customer Lifestyle Acquisition:

Acquisition -> CAC (cost adquisition customer)

Activation -> CR (conversion rate) & Frecuency

Retention -> Customer Churn & LTV (life-time-value)

So, you should try new ideas and learn from mistakes.

Week by week you analyze the week before and think of new propositions to improve your client’s experience.

It’s important to focus and have a visual goal of each action; it’s very different to build an online campaign to gain awareness or to implement a cross-category discount very focus on basket mix and improvement of LTV with Customer Conversation as a set goal.

If you have very limited resources you just to need to center on those actions that will have the most impact while still ROI positive.

Little bonus advice: customers usually are not mono-category and sometimes categories of products that you normally wouldn’t associate as complementary may surprise you. 😉

-> Empowering growth in a diverse and complete category dynamic experience has more sustainable long impact rate of success. <-

Lastly, as Gary Vee would say “Macro Patience and Micro Speed”.

What’s next?

Not only Baby Shoppers are going to be the experts to purchase online grocery, sooner than ever everyone will look for their usual products and necessities online. It’s just a big opportunity to learn and discover new methodologies with them.

The journey looks good and we will keep in touch ✌️

*this article is strictly from a personal point of view